In the age of digitization, more and more companies are falling victim to cyber-attacks. It estimates that two in every three companies were affected by cyber-attacks. Although, cyber-attacks have long since ceased to be the only target of large corporations, attackers are increasingly targeting small companies. This is precisely why cybersecurity has become extremely important in companies. In particular, securing privileged user accounts and critical systems are on the agenda of many companies to be able to ward off attacks and reduce risks. Cyber insurance policies are also used to supplement the internal security measure and reduce the financial consequences in an emergency.

Cybercriminals worldwide access the IT systems of banks, insurance companies, and other companies in different ways and try to exploit security gaps in the IT security to gain access to confidential and protected data. If an attacker succeeds in circumventing the security mechanisms to gain unauthorized access, an attempt is made to smuggle malware into the company’s network to encrypt essential data. In this status of criminal intrusion, companies are asked to pay a ransom. Otherwise, the data is threatened with destruction.

The most common type of attack is aimed at stealing customer data. Companies with fewer than 100 employees are particularly at risk of falling victim to a cyber-attack. They are an attractive target for attackers, often due to insufficient IT security precautions and strong link with supply chains of more prominent corporations. The costs resulting from a cyber-attack are only part of the damage a company has to deal with. In addition, there is often damage to image and reputation, which leads to unplanned financial expenses.

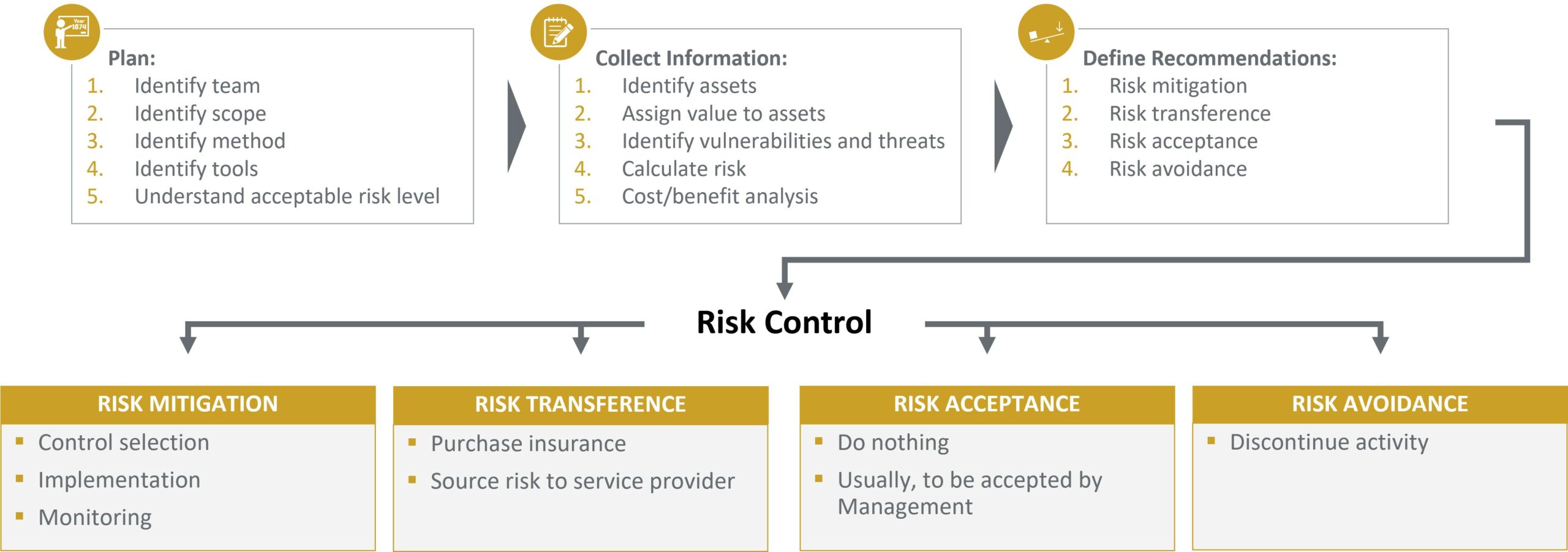

Figure 1: Risk Management Process

The Covid-19 pandemic left companies with no choice to switch to home office. This sudden need resulted in a flurry of security challenges and the private devices that log into the company network represent enormous weaknesses in the IT infrastructure. Due to the steadily increasing number of cyber-attacks, investments in the security infrastructure of companies are increasing, but there is also strong growth in insurance companies that offer unique insurance products to minimize the effects of a security incident.

This is where cyber insurance comes to play, supporting internal company efforts in the field of cybercrime such as malware, ransomware or DDoS attacks. It can also cover losses due to data breaches, intellectual property theft, and loss of privacy.

An important point and rationale behind any insurance is a risk mitigation strategy. Cyber insurance can minimize financial liability in the event of a data breach and reduce the potentially significant financial cost of a major cyber incident. In addition, insurance can provide a smooth funding mechanism for repairing serious losses, helping businesses return to normal and reducing the need for government assistance.

By combining a cyber insurance and an adapted security architecture, a company can protect itself from the potentially enormous financial costs of a significant cyber incident, but should not be reliad on as the only measure of cybersecurity. As is so often the case, that the prevention of security incidents is the key to success and the measures to prevent a cyber-attack are usually significantly cheaper than the costs in the event of a claim.

If your organization wants to identify their risks to prevent a security incident, contact us. Our Cybersecurity Readiness Assessment and Risk Assessment will identify your gaps and work out what you need in order to bridge them.

Recent Comments